Redeeming your points and miles for travel-related expenses like flights and accommodations is fantastic, but remember that additional costs—such as car rentals, train tickets, gas, and campground fees—can quickly add up. Fortunately, combining cash-back rewards with your points and miles can lead to even greater savings for your next trip.

With that in mind, let’s explore the often-ignored Bank of America Preferred Rewards® program. Besides the standard banking advantages available to members, consolidating your finances with Bank of America can significantly enhance your cash-back rewards through some of the top Bank of America credit cards.

The Preferred Rewards program was designed by Bank of America to encourage customers to consolidate their checking, savings, investments, and retirement accounts with Bank of America and Merrill. The greater your total asset balance with the bank, the more benefits you’ll access, including rewards through its credit cards. Depending on your asset levels and the types of rewards you wish to earn, it may be time to take a closer look at the Bank of America Preferred Rewards program.

Related: 5 reasons to apply for the Bank of America Premium Rewards credit card

Overview of the Bank of America Preferred Rewards Program

Here’s a brief overview of the program:

Eligibility for the Bank of America Preferred Rewards Program

To be eligible for the Bank of America Preferred Rewards program, you must meet both of the following requirements:

- Have an active, eligible checking account with Bank of America.

- Maintain a three-month average daily balance of at least $20,000 in qualifying Bank of America deposit and/or Merrill investment accounts.

There are five tiers in the Preferred Rewards program, each determined by your combined average daily balance:

- Gold: $20,000 or more in total assets

- Platinum: $50,000 or more in total assets

- Platinum Honors: $100,000 or more in total assets

- Diamond: $1,000,000 or more in total assets

- Diamond Honors: $10,000,000 or more in total assets

Daily Newsletter

Stay informed with the Flying Frugal Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides, and exclusive deals from Flying Frugal’s experts

While these thresholds may seem high, don’t be discouraged too quickly. If you have an emergency fund, holiday savings, a checking account, and a savings account, by combining those balances, you could qualify for a Preferred Rewards tier. Additionally, incorporating investment accounts like IRAs can help you reach the Platinum or Platinum Honors tiers.

Your balance doesn’t have to come solely from Merrill or Bank of America to count towards each tier requirement. You can transfer existing IRAs and investment accounts to Merrill or Bank of America to start building a three-month average that could boost you into a higher tier. Just keep in mind factors like account management fees and available investment options to determine if this approach is right for you.

Related: Maximize your earnings with the Bank of America Premium Rewards Card

Advancing Through Preferred Rewards Tiers

You can advance to the next tier once your average daily balance meets the requirement for the subsequent level over the previous three months. Once you achieve a tier, you don’t need to keep all your funds tied up with Bank of America.

Your Preferred Rewards tier will remain active for an entire year. If, after a year, you no longer meet the qualification requirements, you’ll have a three-month grace period to regain eligibility. Should you still fail to meet the criteria inside that period, you will be either downgraded to a lower tier or lose your Preferred Rewards benefits entirely.

Related: Is the Bank of America Premium Rewards Card worth its $95 annual fee?

Benefits of the Bank of America Preferred Rewards Program

The following chart summarizes the five Preferred Rewards tiers and their respective benefits:

| Benefit | Gold | Platinum | Platinum Honors | Diamond | Diamond Honors |

|---|---|---|---|---|---|

| Credit Card Rewards Bonus | 25% | 50% | 75% | 75% | 75% |

| Savings Interest Rate Booster | 5% | 10% | 20% | 20% | 20% |

| Mortgage Perks | $200 Origination Fee Reduction | $400 Origination Fee Reduction | $600 Origination Fee Reduction | 0.250% Interest Rate Reduction (when PayPlan is established) | 0.375% Interest Rate Reduction (when PayPlan is established) |

| Auto Loan Interest Rate Discount | 0.25% | 0.35% | 0.50% | 0.50% | 0.50% |

| Home Equity Interest Rate Discount | 0.125% | 0.250% | 0.375% | 0.625% | 0.750% |

| No-Fee Banking Services | Included | Included | Included | Included | Included |

| Free Non-Bank of America ATM Transactions | N/A | 12 per Year | Unlimited in the U.S. | Unlimited in the U.S. and Internationally | Unlimited in the U.S. and Internationally |

| Merrill Guided Investing Fee Discount | 0.05% | 0.10% | 0.15% | 0.15% | 0.15% |

| Foreign Currency Exchange Rate Discount | 1% | 1.5% | 2% | 2% | 2% |

| Access to Exclusive Lifestyle Benefits | N/A | N/A | N/A | Yes | Yes |

Now, let’s dive deeper into each of these benefits.

Savings Interest Rate Booster

To take advantage of this benefit, you need a Bank of America Advantage Savings account and must be an enrolled member of Preferred Rewards. Just keep in mind that your existing savings account won’t automatically convert to an Advantage Savings account upon enrolling; you have to request this conversion when joining.

At the Gold tier, the interest rate boost is 5%, which may seem appealing at first; however, a base interest rate of 1.00% would only increase to 1.05% with this boost.

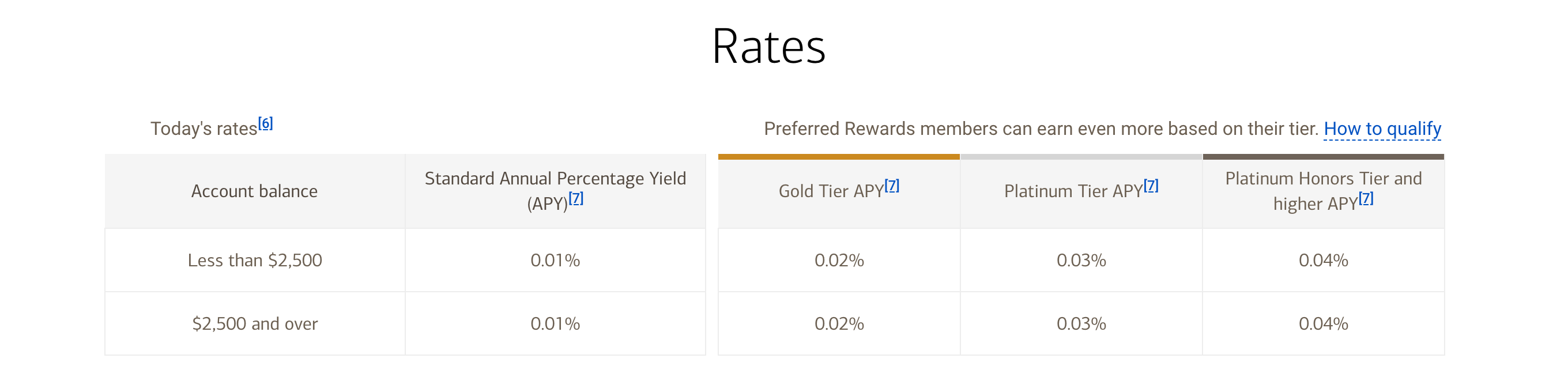

For context, here’s the annual percentage yield on a Bank of America Advantage Savings account as of January 2025:

You can assess how the boost would affect the current annual percentage yield on a Bank of America Advantage Savings account in your location here.

Related: The best ways to save money & earn travel rewards for kids

Credit Card Rewards Bonus

Members of the Preferred Rewards program earn a rewards bonus of 25%, 50%, or 75% on selected Bank of America cards. This bonus is applicable on all purchases made with credit cards that yield points or cash rewards.

Your bonus earning rate is determined by your Preferred Rewards tier when purchases are charged to your account. We’ll delve into how this works with specific cards below.

The Preferred Rewards bonus can be earned on most Bank of America consumer-branded credit cards, including the Bank of America® Premium Rewards® credit card, the Bank of America® Travel Rewards credit card, the Bank of America® Unlimited Cash Rewards credit card, and the Bank of America® Customized Cash Rewards credit card, among others.

Related: Chase Sapphire Preferred vs. Bank of America Travel Rewards — which card should beginner travelers choose?

Mortgage Origination Fee Reduction

Reducing fees associated with buying or refinancing a home is always advantageous. Preferred Rewards members can receive a fixed fee reduction, provided in one of two forms based on their membership tier:

- A fixed dollar amount off the origination fee (capped at its total cost)

- A percentage off your mortgage’s APR

Note that the Preferred Rewards fee reduction is non-transferable, and combining this discount with other promos may not be permitted.

Related: Credit card strategies for mortgage and home loan applicants

Auto Loan Interest Rate Discount

To receive a rate discount, you must secure an auto purchase or refinancing loan through Bank of America. This benefit is also non-transferable, so only the member can utilize it.

When seeking this discount, be sure to confirm that Bank of America offers a competitive rate post-discount, as even a slight difference in interest rate could result in significant savings or costs over the loan’s duration.

Related: What is a good credit score?

Home Equity Interest Rate Discount

Members can enjoy a home equity line of credit interest rate discount of up to 0.75%, depending on their Preferred Rewards tier.

This offer is non-transferable, but you might be able to combine it with other home equity interest rate discounts. Even co-borrowers qualify as long as at least one applicant is enrolled or eligible for enrollment.

Related: Credit card vs. line of credit: What’s the difference?

No-Fee Banking Services

Preferred Rewards members benefit from several banking services at no cost.

These services include the following:

- ATM/Debit card rush fees

- International transaction fees for ATMs

- Monthly maintenance fees for up to four eligible checking and four savings accounts from Bank of America

- Non-Bank of America ATM fees for withdrawals, transfers, or balance inquiries

- One waived overdraft protection transfer fee per billing cycle

Furthermore, Platinum members and above do not incur fees for incoming international wire transfers and can open a small safe deposit box free of charge at a Bank of America location.

Related: Strategies to sidestep ATM fees

Free Non-Bank of America ATM Transactions

Platinum and Platinum Honors members enjoy the following benefits when using non-Bank of America ATMs in the U.S. and its territories:

- No charges for non-Bank of America ATM usage

- Refund of any ATM operator or network fees for withdrawals, balance inquiries, and balance transfers

Platinum members are allowed one free transaction per statement cycle (up to 12 annually), while Platinum Honors members enjoy unrestricted free transactions. Diamond and Diamond Honors members get unfettered access to fee-free transactions within the U.S. and abroad.

Related: 7 tips to save on overseas ATM withdrawals

Merrill Guided Investing Fee Discount

Preferred Rewards members receive a fee discount when utilizing Merrill Guided Investing services. You can start investing with just $1,000 for Merrill Guided Investing or $20,000 for Merrill Guided Investing with an advisor.

Merrill Guided Investing typically incurs a fee of 0.45% of the assets under management, and investment through Merrill Guided Investing with an advisor usually incurs a fee of 0.85% of assets under management.

Though these percentages may appear minor, they can accumulate significantly over time. As a result, even these seemingly low fees can considerably impact your investments in the long run; seeking a financial advisor who charges fixed fees instead of a percentage may be a better choice.

Related: The best apps for managing money

Foreign Currency Exchange Rate Discount

All Preferred Rewards members receive a discount when ordering foreign currency through online banking or the mobile app.

The discount varies based on your tier, ranging from 1% to 2%.

Related: Everything you need to know about foreign transaction fees

Exclusive Lifestyle Benefits Access

Diamond and Diamond Honors members enjoy unique lifestyle experiences, including exclusive curated offerings in travel, wellness, events, dining, and other personal services. Preview some of these offers here.

Related: The best credit cards available now

Maximizing Cash Rewards Through Bank of America Credit Cards and Preferred Rewards

For maximizing the benefits of the Bank of America Preferred Rewards program, aim to qualify for at least the Platinum Honors tier, which grants a 75% bonus on credit card rewards.

While you shouldn’t base significant investment and banking decisions solely on credit card incentives, it may be worth considering if you already intend to invest with Merrill and maintain a banking connection with Bank of America. If so, here’s a look at some of Bank of America’s rewards credit cards and how to make the most of your cash-back earnings.

Related: How to select the best credit card for your needs

Bank of America Premium Rewards Credit Card

The Bank of America Premium Rewards credit card stands out as a solid choice for rewards, and it becomes even more advantageous when combined with the bonuses from the Preferred Rewards program.

This card has an annual fee of $95 and provides a range of benefits, including up to $100 in annual airline incidental fee credits, a Global Entry or TSA PreCheck application fee credit every four years (up to $100), along with decent travel protections.

Moreover, this credit card excels in its earning rates for everyday and travel-related purchases. The following outlines the earning rates when considering the Preferred Rewards program bonus:

| Spending Categories | Standard Cardholder | Gold (25% bonus) | Platinum (50% bonus) | Platinum Honors, Diamond, and Diamond Honors (75% bonus) |

|---|---|---|---|---|

| Travel and Dining | 2 Points per Dollar Spent | 2.5 Points per Dollar Spent | 3 Points per Dollar Spent | 3.5 Points per Dollar Spent |

| All Other Purchases | 1.5 Points per Dollar Spent | 1.875 Points per Dollar Spent | 2.25 Points per Dollar Spent | 2.625 Points per Dollar Spent |

The potential to earn at least 2.625% on all purchases for high-tier Preferred Rewards members is remarkable. This return positions the Bank of America Premium Rewards credit card among the most rewarding options for everyday spending.

Related: Full review of the Bank of America Premium Rewards credit card

Bank of America Travel Rewards Credit Card

If avoiding credit card annual fees is a priority, consider the Bank of America Travel Rewards credit card, which earns 1.5 points per dollar spent on all purchases. Points can be redeemed to cover travel expenses at a conversion rate of 1 cent per point.