When applying for a credit card, it’s essential to know which credit bureau the bank will consult to access your credit report.

Your credit report serves as a comprehensive account of your financial history and plays a crucial role in determining whether you’ll be approved for a new credit line, like a credit card.

In the U.S., the three primary credit bureaus—Equifax, Experian, and TransUnion—can be accessed by banks and credit card companies to retrieve your credit report.

Related: How to check your credit score for free

The credit reporting agency (CRA) chosen by a card issuer can heavily influence the outcome of your application, particularly if you’re submitting multiple applications in a short time frame. If different card issuers utilize the same bureau, it could negatively impact your approval chances.

On the other hand, if card issuers use different credit bureaus to obtain your reports, one issuer might not see that you’re applying for additional credit elsewhere, potentially increasing your chances of approval.

Note that multiple credit applications can hurt your score, so it’s important to understand the implications of applying for several cards simultaneously.

Before You Apply for a New Credit Line

Knowing your credit status is vital before applying for any credit. Be sure to check your credit score and reports beforehand.

Review Your Credit Report

Your credit report provides a comprehensive view of your credit activities, including payment history, outstanding debts, and credit inquiries. Familiarizing yourself with your credit health will help you understand how lenders may view your application. Fortunately, obtaining your three credit reports is a straightforward process.

Daily Newsletter

Keep your inbox updated with the Flying Frugal Daily newsletter

Join over 700,000 readers for breaking news, detailed guides, and exclusive deals from Flying Frugal experts

You can obtain a free report from Equifax, TransUnion, and Experian once a year online at AnnualCreditReport.com.

Related: How to correct errors on your credit report

Check Your Credit Score

Your credit report lays out your credit history; however, it typically doesn’t include your current credit score, so be sure to check that separately.

While determining your credit score can be intricate, there are hundreds of commercially available scores, and some lenders use custom models. As a result, there are numerous variations of credit scores.

The two most commonly used credit scoring models in the U.S. are FICO and VantageScore, the latter having grown in popularity since its introduction in 2006.

Despite this, FICO remains the industry benchmark, with about 90% of lenders using it for credit decisions. Many banks also offer free access to FICO scores for their cardholders as a benefit.

What is a FICO Score?

Your FICO score ranges from 300 to 850 based on the information in your credit report.

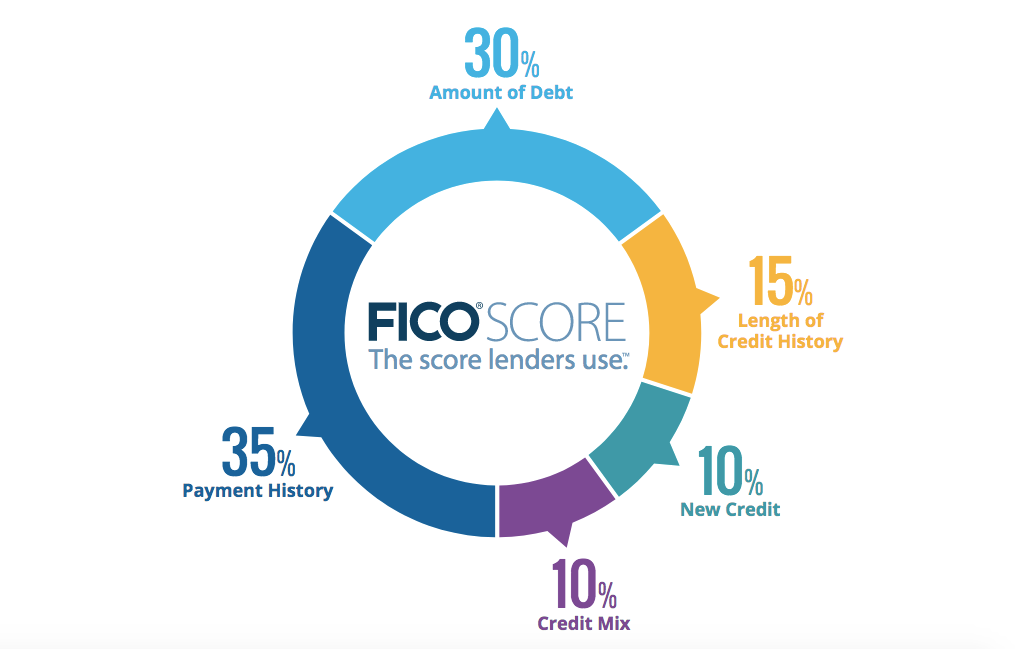

FICO scores are calculated from various aspects of your credit data, sorted into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%).

Lenders utilize this score to evaluate your creditworthiness — the higher your score, the greater your chances of receiving approval for credit cards and loans.

According to FICO, a “good” credit score ranges from 670 to 739, while a score of 740-799 is deemed “very good,” and 800+ is considered “exceptional.” However, pursuing an ideal score of 850 isn’t essential. In most circumstances, credit card issuers don’t significantly differentiate between scores above 720, so achieving a strong score within this range is usually sufficient for securing top offers.

Which Credit Bureaus Do Banks Consult — and Why is it Important?

When you apply for a credit card, the issuer checks one (or more) credit bureaus to obtain your credit report, which includes the five categories previously mentioned.

Related: What is a good credit score?

One of the credit report categories, comprising 10% of your score, is labeled “new credit.” Numerous applications for new credit in a short span can negatively impact your score.

Consider this scenario: You’ve submitted several applications for new credit, such as loans or credit cards, within the past year. These applications appear as “hard inquiries” on your credit reports, which could negatively affect your credit score.

When you then apply for another credit card, not only could your score drop further, but the bank processing your application may also question the reasoning behind your multiple applications for new credit. This could result in a denial, even if your score is healthy.

Understanding which credit bureau card issuers choose can help you steer clear of such issues. With this information, you can better time your applications to improve your chances of approval for the credit cards you’re after.

Related: 5 things to check before applying for your next credit card

Many credit card companies tend to rely on one bureau when processing applications, though which bureau they use may vary based on your state and the particular credit card in question.

Here’s a look at the credit bureaus frequently used by three prominent issuers:

- Citi typically accesses either Equifax or Experian, although they consult all three bureaus.

- American Express usually pulls from Experian, but also accesses Equifax and TransUnion on occasion.

- Chase primarily favors Experian but is known to obtain reports from all three bureaus as well.

Keep in mind, however, that there’s no guaranteed way to determine which credit bureau a credit card issuer will utilize.

Conclusion

Your credit report is a vital component of your financial identity, significantly affecting your creditworthiness. By understanding which credit bureau banks reference for your credit information, you may improve your chances of approval for your next credit card application.

Related: 4 common credit score myths