Unfortunate news for points and miles enthusiasts: Some U.S. senators are attempting to insert the Credit Card Competition Act (CCCA) as a “poison pill” amendment into pending congressional legislation.

Last week, Senator Roger Marshall, a Republican from Kansas, introduced an amendment co-sponsored with Senator Dick Durbin, a Democrat from Illinois, to include the CCCA in the Guiding and Establishing National Innovation in U.S. Stablecoins Act.

The GENIUS Act initially garnered bipartisan support and seemed poised to surpass the essential 60-vote threshold needed to pass in the Senate. Advocates argue that it would enhance regulation within the cryptocurrency market and foster greater stability across digital currency systems.

Senate Majority Leader John Thune is permitting amendments to the legislation, raising the possibility of the CCCA being attached if senators approve the addition. However, at least one senator has indicated he would withdraw his support for the GENIUS Act if the CCCA is included.

“If it were to be adopted into GENIUS, I would rescind my support on the Senate floor,” stated Senator Thom Tillis, a Republican from North Carolina, as reported by the Washington Reporter.

Several other senators, including Republicans Cynthia Lummis from Wyoming and Bill Hagerty from Tennessee, are advocating for a “clean” vote on the GENIUS Act without any amendments.

Vice President JD Vance is also demanding a vote free from the CCCA-linked legislation.

If Marshall and Durbin succeed, and the Senate votes to adopt the amendment, the CCCA will be added, forcing senators to choose between opposing otherwise popular legislation or allowing it to pass with the contentious amendment attached.

Daily Newsletter

Keep your inbox informed with the Flying Frugal Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides, and exclusive offers from Flying Frugal’s experts

Tell Congress to protect your credit card rewards: Defend Your Points

“This serves as a political favor to large campaign donors supporting the bill,” remarked Richard Hunt, executive chairman of the Electronic Payments Coalition.

The Electronic Payments Coalition represents credit unions, community banks, and payment card networks.

“This bill has never undergone a relevant committee review, never been debated, and wasn’t reintroduced this Congress,” Hunt continued. “Unlike the sponsors of the GENIUS Act, those behind the Durbin-Marshall [CCCA] have not performed their due diligence.”

Flying Frugal firmly opposes the CCCA, believing it could dismantle the consumer-friendly benefits associated with credit cards.

What is the Credit Card Competition Act?

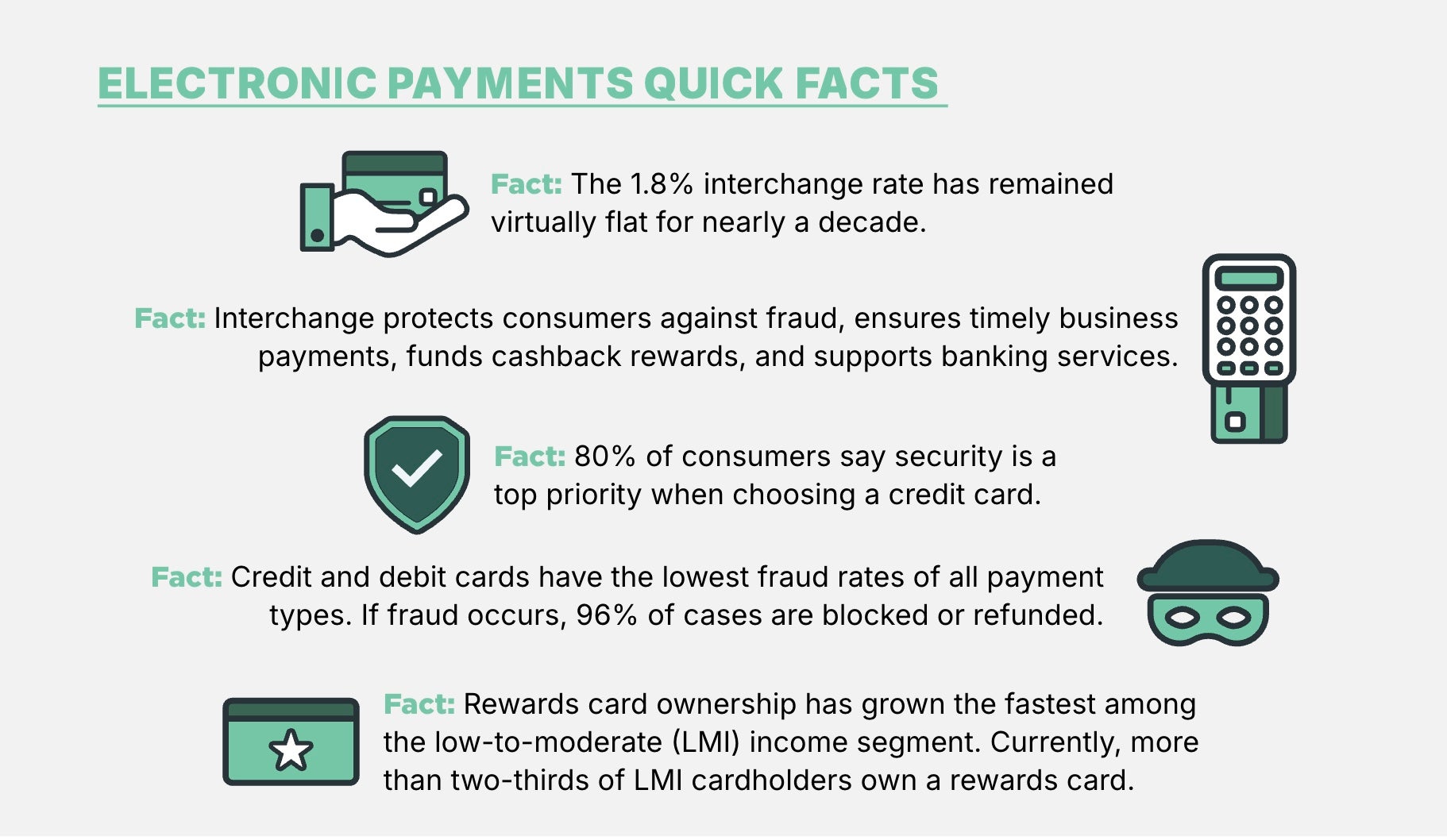

The CCCA proposes price controls on interchange fees, which could drastically reduce or eliminate lucrative sign-up bonuses and points-earning potential for many credit cards tied to banks, airlines, and hotels.

Similar legislation passed for debit cards in 2010 promised consumers lower prices due to reduced transaction fees, but instead, rewards disappeared and prices increased.

A study from the International Center for Law and Economics revealed that caps on interchange fees for debit transactions cost large banks between $6.6 to $8 billion annually, leading to fewer free checking accounts and diminished rewards programs.

The Electronic Payments Coalition noted that “the Durbin-Marshall bill allows corporate giants like Walmart, Target, and Home Depot to choose the cheapest processing option, disregarding consumer security and benefits.”

Additionally, the Coalition highlighted:

- The bill might shift transactions to unproven networks, compromising fraud protections and increasing expenses for businesses and consumers.

- It threatens credit card rewards, including cash back that aids consumers in combating inflation and supporting small businesses.

- Small businesses could incur higher costs and fewer benefits associated with card payments.

Research indicates that this bill could trigger an economic slowdown, resulting in an estimated $227 billion in lost economic activity and around 156,000 lost jobs.

A study conducted by the University of Miami suggests that the CCCA would severely diminish revenue for community banks and credit unions while restricting access to credit and banking in smaller markets, disproportionately affecting rural and low-income families.

Founded on utilizing credit card rewards to enhance travel savings, Flying Frugal represents a significant interest in this issue.

A broad coalition of organizations, including labor unions, small businesses, and financial institutions across all 50 states, collectively oppose the legislation.

How to Protect Your Points

At Flying Frugal, we partner with major credit card issuers, and our team—along with millions of readers—recognizes how rewards programs enhance travel accessibility. These opportunities could be jeopardized by the passage of the CCCA as part of the GENIUS Act.

“This would be catastrophic for consumers,” said Flying Frugal founder Brian Kelly. “… [They] would miss out on rewards, purchase protections, and fraud safeguards, while retailers benefit financially.”

Working with the Electronic Payments Coalition, Flying Frugal has established Protect Your Points, an advocacy initiative enabling readers to voice their opposition to the bill to local representatives and senators.

Click here to fill out a brief form. Please take 30 seconds today to urge your senator to vote against the CCCA amendment to the GENIUS Act.

Related reading: