At Flying Frugal, we have a strong aversion to unnecessary fees, especially foreign transaction fees.

If you’ve ever used certain credit cards abroad or while shopping on a non-U.S. hosted site, you might have noticed an extra charge on your purchases.

Let’s take a moment to clarify what these fees are and how to avoid them moving forward.

Related: Top credit cards with no foreign transaction fees

What Are Foreign Transaction Fees?

Foreign transaction fees are charged by some credit cards when a purchase is processed via an international bank.

When making a purchase abroad or through a foreign site, your bank may need to convert the transaction into U.S. dollars. In such cases, some credit card issuers pass on the conversion costs to cardholders.

Related: The best business credit cards with no foreign transaction fees

How Much Are Foreign Transaction Fees?

Visa and Mastercard impose a 1% processing fee for transactions completed internationally, while several U.S. issuers add an additional 1-2%. As a result, typical foreign transaction fees range around 3%. However, Capital One and Discover stand out by offering credit cards with zero foreign transaction fees.

Which Cards Have No Foreign Transaction Fees?

Most leading travel credit cards do not impose foreign transaction fees. It’s fairly uncommon for cards that provide travel rewards and benefits to charge these fees.

Daily Newsletter

Stay informed with the Flying Frugal Daily newsletter

Join over 700,000 subscribers for breaking news, detailed guides, and exclusive offers from Flying Frugal’s experts.

While several issuers charge foreign transaction fees approximating 3% on certain accounts, it’s beneficial to consider cards from Capital One or Discover, as they don’t impose foreign transaction fees on any of their offerings.

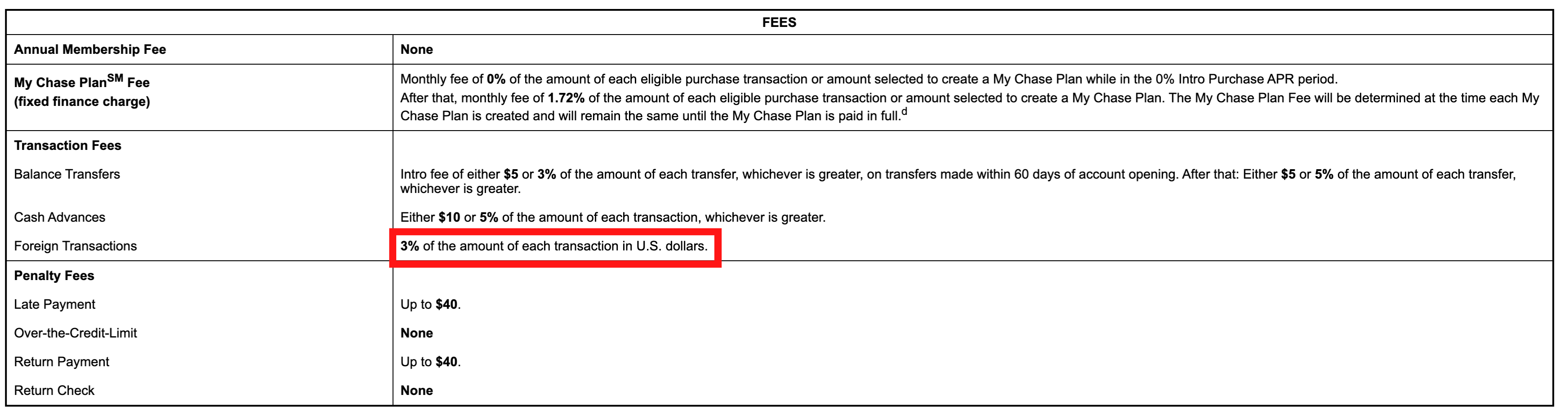

Credit card issuers must disclose the associated rates and fees, including foreign transaction fees. Review your credit card’s terms and conditions to determine if fees apply.

In the rates and fees table, the foreign transaction fee is generally clearly listed under the fees section.

Related: Tips for choosing a no-foreign-transaction-fee credit card

Foreign Transaction Fees vs. ATM Fees

While traveling, you might encounter foreign ATM fees. It’s important to note that these fees differ from foreign transaction fees.

A foreign ATM fee is incurred when cash is withdrawn from an ATM overseas. Several banks may waive this fee, especially if you use an ATM within a specific network.