When considering cobranded airline cards, many only think about those from airlines they frequently use. The main benefits of these cards often include priority boarding, complimentary checked bags, and expedited steps to elite status with the respective airline.

I often suggest looking beyond the card’s airline or hotel partnership when evaluating its value.

Take the Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) as an example. This card includes a complimentary Admirals Club membership, justifying its $595 annual fee. At first glance, it may seem ideal only for devoted American Airlines travelers.

However, an Admirals Club membership provides added value: free access to Alaska Airlines lounges. Here’s how loyalists to Alaska can fully utilize this card without ever flying American Airlines.

Access to Alaska Airlines Lounges

Your Admirals Club membership entitles you to complimentary access to Alaska lounges when flying on the same day with American, Alaska, or Hawaiian Airlines. Keep in mind that this access doesn’t apply to authorized users, and you’ll need to present your physical card upon entry.

While a standard Alaska Airlines lounge membership costs $595 per year—matching this card’s fee—enrolling in the AAdvantage Executive gives you lounge access along with all its additional perks.

No matter if you’re flying American, Alaska, or another Oneworld airline, you can also enter Admirals Club lounges without extra charges.

If you wanted to access partner lounges solely with an Alaska Airlines lounge membership, you’d need to pay $795 a year for the Alaska Lounge+ membership, which is $200 more than the cost of the AAdvantage Executive.

While the Alaska Lounge+ membership allows access to a few lounges not included with the AAdvantage Executive, most partner lounges are covered by this card.

Booking Alaska Flights with American Airlines Miles

While the AAdvantage Executive earns American Airlines miles, this may initially appear less relevant to an Alaska loyalist. In fact, it presents a significant opportunity.

American Airlines miles are usable for booking Alaska Airlines flights, allowing you to maximize the card’s value beyond just lounge access. Additionally, there are great itineraries that combine both Alaska and American flights.

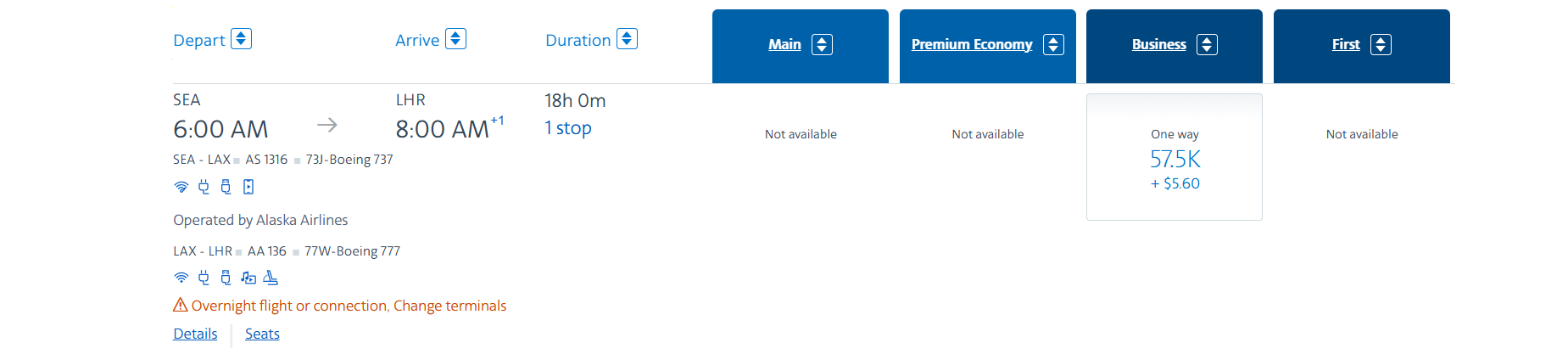

For instance, you could book a one-way business-class ticket from Seattle-Tacoma International Airport (SEA) to Heathrow Airport (LHR) for 57,500 miles plus a mere $5.60 in taxes and fees. Booking this itinerary with cash would set you back $3,483—yielding a value of 6 cents per point.

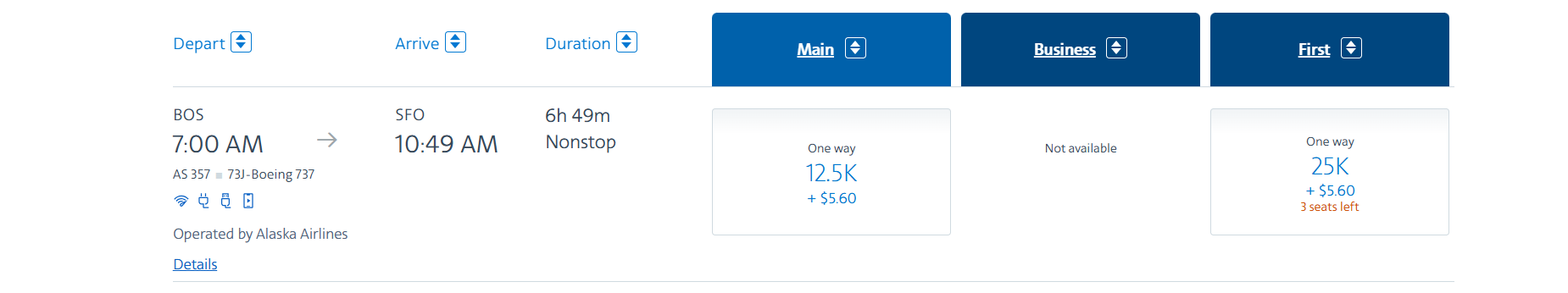

If you typically fly domestically, there are plenty of options, too. For example, you could book a nonstop economy flight on Alaska from Boston Logan International Airport (BOS) to San Francisco International Airport (SFO) for 12,500 miles plus $5.60 in taxes and fees.

This flight would cost $304 if booked with cash, providing a value of 2.4 cents per point—excellent for a domestic economy flight.

To delve deeper into the value of American Airlines miles, check out our comprehensive guide to the AAdvantage program.

How to Earn American Airlines Miles

Currently, you can earn 100,000 bonus miles after spending $10,000 within the first three months of obtaining the AAdvantage Executive. This bounty of miles can be redeemed for Alaska flights or potentially a couple of American flights, especially if you find a special deal.

In addition to its welcome bonus, this card has straightforward earning rates that help you collect even more American miles. You earn 10 miles per dollar on hotels booked through aadvantagehotels.com and car rentals made through aadvantagecars.com. You’ll also receive 4 miles per dollar spent on American Airlines purchases and 1 mile per dollar on everything else.

If you spend $150,000 or more annually on this card, you’ll earn 5 miles per dollar on American Airlines purchases—an increase from 4 miles—until the year’s end.

While I don’t typically recommend non-American Airlines purchases with this card, if your focus is on accumulating miles for Alaska flights, it may be worth using this card for select purchases, particularly those not covered by other bonus categories.

Additional Benefits

Even though it’s an American Airlines-branded card, the AAdvantage Executive provides various benefits usable without flying.

If you frequently rent cars while traveling, you’ll appreciate the card’s rental car statement credit, offering up to $120 back annually on eligible prepaid rentals from Avis or Budget—just remember to book online to qualify for the credit.

If car rentals aren’t usually part of your plans, this card can still help reduce your travel costs. You can receive up to $120 each year on Lyft rides. To qualify for the $10 monthly credit, you need to take three rides, making this benefit best suited for those who regularly use Lyft throughout the month.

Moreover, you’ll earn up to $10 each billing statement for Grubhub purchases, which is ideal for anyone who occasionally orders takeout—consider picking up instead of opting for delivery to stretch the credit further.

While these credits may be lifestyle-specific, they can provide significant value if you can utilize them effectively.

An easily accessible benefit for any traveler is the TSA PreCheck/Global Entry application fee credit associated with this card. If you already have either, you can still use your AAdvantage Executive to cover someone else’s application fee.

Lastly, this card includes essential travel protections that are available regardless of whether you fly with American Airlines, including trip cancellation and interruption protection, lost baggage insurance, and trip delay protection—benefits that can safeguard your next trip with Alaska.

Conclusion

To access Alaska lounges with a standard membership, you’d have to spend $595 annually. By choosing the AAdvantage Executive instead, you can enjoy access to Alaska, Admirals Club, and Qantas lounges, as well as American Airlines miles for Alaska flights, statement credits, and crucial travel protections.

For any Alaska loyalist, applying for the AAdvantage Executive seems like an obvious choice, especially with its current offer of a 100,000-mile welcome bonus. Plus, it’s an excellent backup if you ever want to try American Airlines.

To find out more, check out our full review of the Citi / AAdvantage Executive.

Apply here: Citi / AAdvantage Executive World Elite Mastercard