While IHG One Rewards is often overshadowed by popular loyalty programs like Marriott Bonvoy and World of Hyatt, it still offers a wide range of hotels and resorts around the globe, allowing for valuable redemptions of IHG points.

Accumulating IHG points is quite straightforward. For instance, those who sign up for the IHG One Rewards Premier Credit Card can receive a bonus of 140,000 points after spending $3,000 within the first three months. Similarly, new applicants for the IHG One Rewards Premier Business Credit Card can also earn 140,000 bonus points by spending $4,000 in the initial three months, along with an additional 60,000 points after reaching a total of $9,000 in the first six months, if they apply by April 30.

Now, let’s explore how to get the most out of your IHG One Rewards redemptions.

Determine Your IHG Redemption Rate

IGH operates using dynamic award pricing, meaning the number of points needed for redemption can fluctuate based on various factors such as booking date, selected property, and travel dates.

Despite the fluctuating pricing, you can still achieve great value with your IHG points. According to Flying Frugal’s March 2025 estimations, IHG points are valued at 0.5 cents each, though you may often secure even better redemption rates.

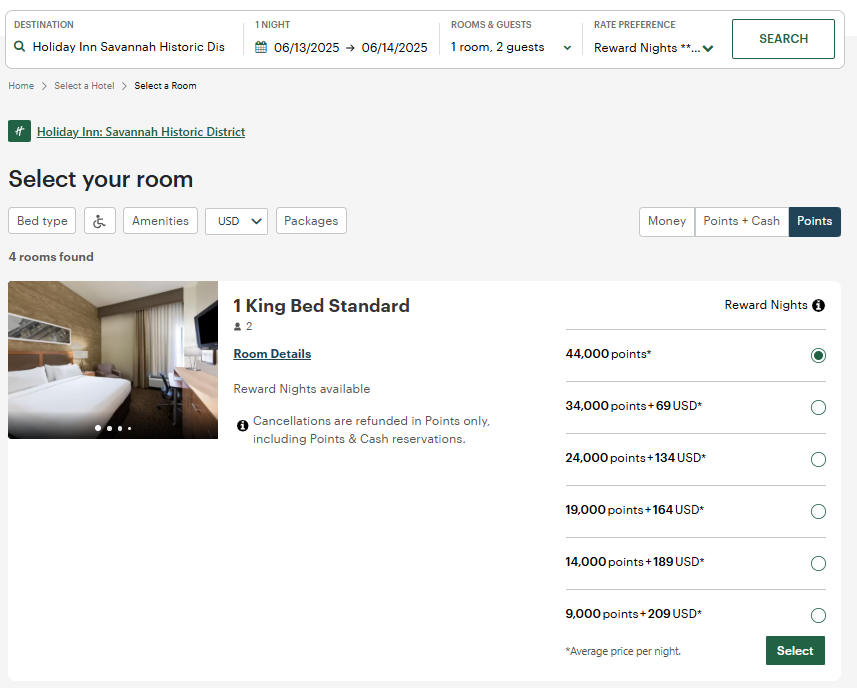

As an example, suppose you’re aiming to book a standard room at the Holiday Inn Savannah Historic District for a night on June 13. You have the option to reserve with free cancellation up to two days prior for a rate of $294.42, or you can use 44,000 points. Choosing the points redemption for this stay will give you a value of 0.67 cents per point.

However, keep in mind that redemption values may not always be favorable. It’s important to compare cash prices and points rates, calculating your redemption value. If the redemption value falls short, consider paying for your stay and conserving your points for a more advantageous redemption opportunity.

Related: The best IHG hotels worldwide

Enhance Your IHG Points by Being Flexible

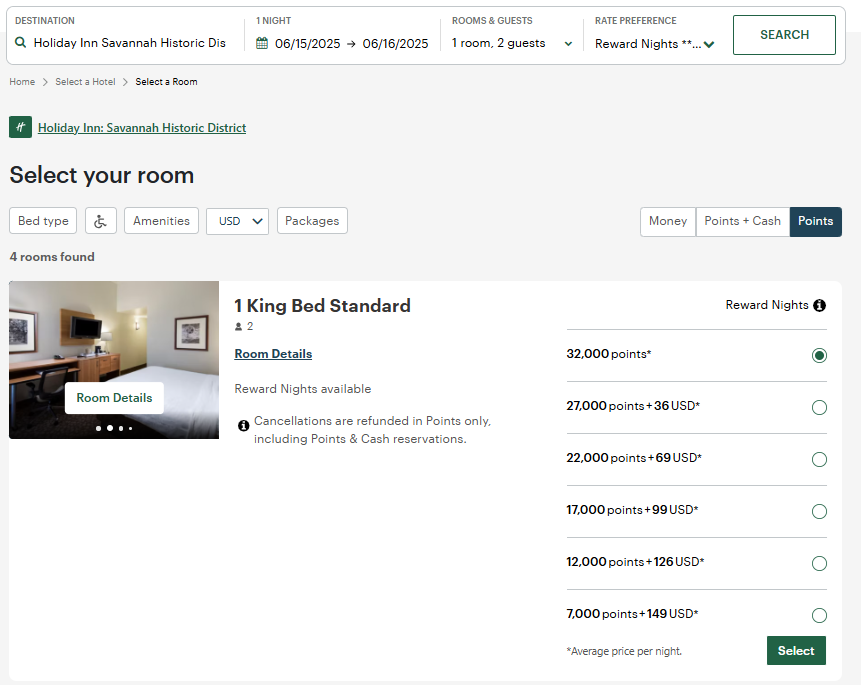

Flexibility can greatly enhance your ability to maximize IHG points. For instance, if you are flexible with your dates, you might find that shifting your stay could require fewer points. In the earlier scenario, moving your stay by two days could lower the cost to 32,000 points at the same hotel.

Daily Newsletter

Stay updated with the Flying Frugal Daily newsletter

Join over 700,000 subscribers and get breaking news, in-depth guides, and exclusive deals from Flying Frugal’s experts.

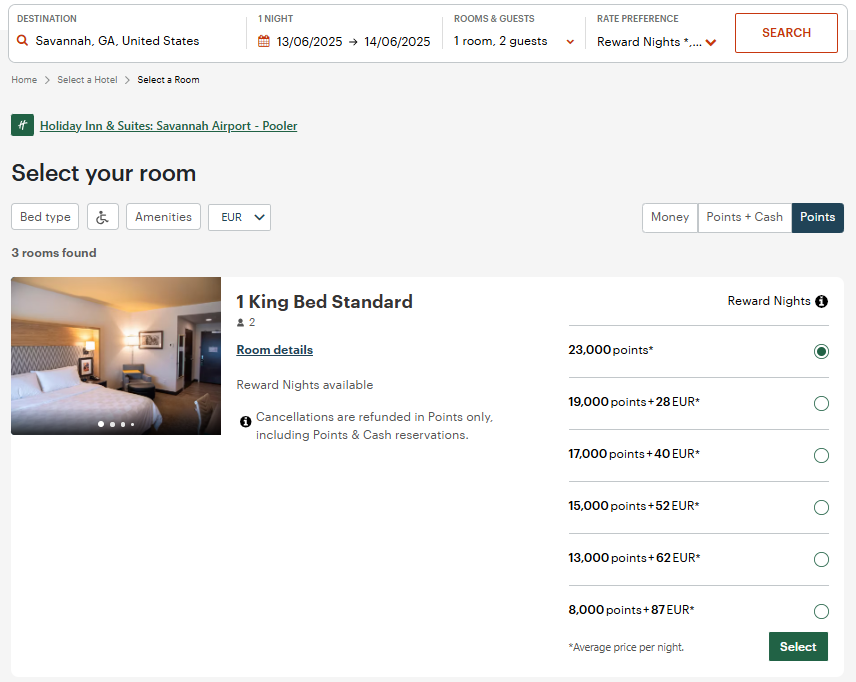

Similarly, if you have flexibility in your choice of location, whether that’s the hotel within a city or even the city itself, you may find ways to reduce the number of points needed. For example, by opting to stay near the Savannah, Georgia, airport, you could reduce your points requirement to just 23,000 points for the previous one-night stay.

In summary, being adaptable with your plans can help you reduce your point expenditure and increase the value of your redemptions.

Related: Which credit card is best for IHG stays?

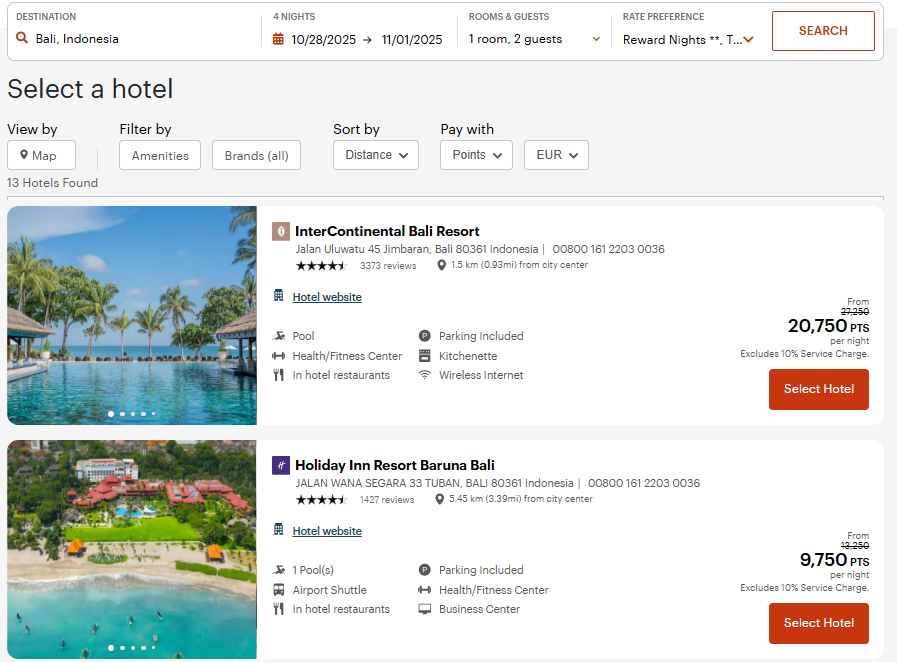

Explore Points + Cash Options

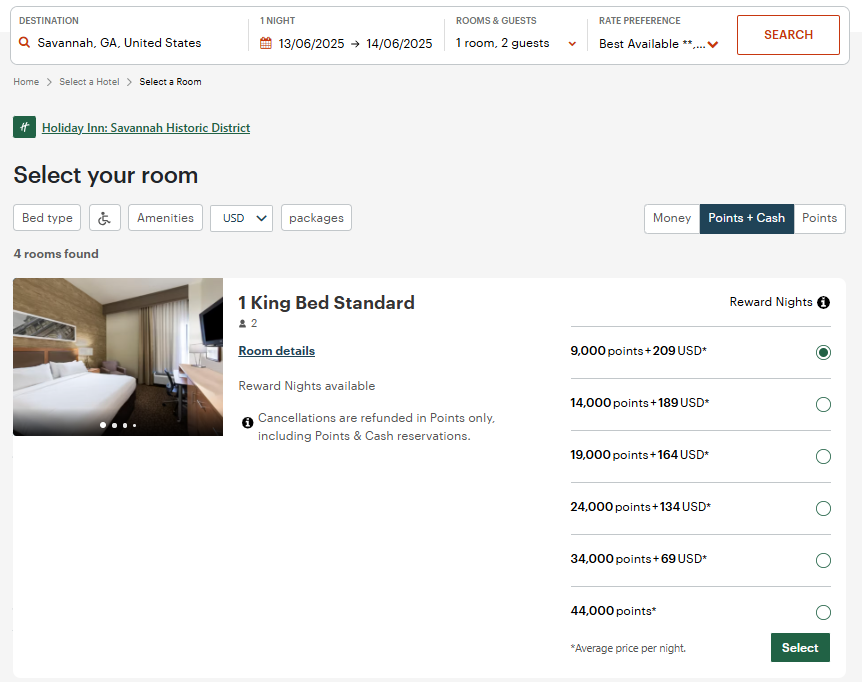

Don’t overlook the benefits of Points + Cash rates. This feature allows you to combine IHG points with cash for your bookings, making your points stretch little further. You can select the “Points + Cash” option when you choose a hotel from the search results.

When considering Points + Cash, be sure to crunch the numbers to ensure it’s a smart choice for your stay. For example, you could book a night for either $294.42 or 44,000 points with various Points + Cash options:

- 44,000 points and $0 (redemption rate of 0.67 cents per point)

- 34,000 points and $69 (redemption rate of 0.66 cents per point)

- 24,000 points and $134 (redemption rate of 0.67 cents per point)

- 19,000 points and $164 (redemption rate of 0.69 cents per point)

- 14,000 points and $189 (redemption rate of 0.75 cents per point)

- 9,000 points and $209 (redemption rate of 0.95 cents per point)

When you use a Points + Cash booking, your cash portion effectively buys points, and if you need to cancel, the refund will be entirely in points, not a mixture of cash and points as initially spent.

Related: IHG points can now be transferred for free: Here’s how

Utilize the IHG Fourth-Night Reward Benefit

If you hold the IHG One Rewards Premier Credit Card, IHG One Rewards Traveler Credit Card, or IHG One Rewards Premier Business Credit Card, you can take advantage of the fourth-night reward perk when you stay for four or more nights using IHG points. This benefit essentially allows you to enjoy every fourth night of your stay for free.

To utilize this benefit, log into an account associated with an eligible IHG credit card, search for a four-night stay or longer, and choose to redeem your IHG points. You’ll notice discounted rates available in your search results.

This perk can be utilized an unlimited number of times each year, and it’s also possible to earn multiple fourth-night rewards during a single stay. For instance, you’d receive two fourth-night rewards for an eight to eleven-night stay and three for a stay of twelve to fifteen nights.

Related: Why you should consider the IHG One Rewards Premier card

Monitor IHG Price Drops

Another effective way to maximize your IHG points is to keep an eye on price drops for award stays you’ve booked.

To do this, perform a new award search for your travel dates to see if prices have decreased. If they have, you can cancel your existing booking and rebook at the lower rate, or if you have a sufficient point balance, consider booking the new stay and then canceling the original higher-priced reservation. Unfortunately, there isn’t a method to reprice IHG award stays without making a new booking.

Related: Should you purchase IHG points or transfer Chase rewards?

Achieve IHG Elite Status

Securing IHG elite status can enhance your stay experiences. The most notable perks, such as the option to select breakfast as a welcome amenity at full-service and select-service hotels, are reserved for top-tier Diamond Elite members. To achieve Diamond Elite status, you’ll need to either stay 70 qualifying nights, earn 120,000 qualifying points, or spend $40,000 on your IHG One Rewards Premier Credit Card or IHG One Rewards Premier Business Credit Card within a calendar year.

Even if achieving Diamond Elite status is challenging, obtaining Platinum Elite status is manageable. This requires 40 qualifying nights or 60,000 qualifying points per calendar year. However, you can also earn Platinum Elite status automatically by joining the InterContinental Ambassador program or by holding the IHG One Rewards Premier Credit Card or IHG One Rewards Premier Business Credit Card.

Securing IHG elite status can be advantageous when redeeming points, as it often offers additional benefits. By enrolling in the InterContinental Ambassador program, you can unlock further perks at participating IHG One Rewards properties like InterContinental and Six Senses.

Related: IHG Milestone Rewards: Earn confirmable upgrades, points, and more

Conclusion

Maximizing redemptions with the IHG One Rewards program is quite attainable. By carefully evaluating redemption rates prior to booking and redeeming points when values are at their highest, you can extract significant worth from your IHG points. If you haven’t already, consider applying for an IHG credit card to enhance your rewards potential.